Mkts turn sluggish on weak China data

Key indices slip for 2nd day on selling in FMCG, IT stocks; Investors in wait and watch mode ahead of inflation data; Weak opening of European mkts also impacted investor sentiment

image for illustrative purpose

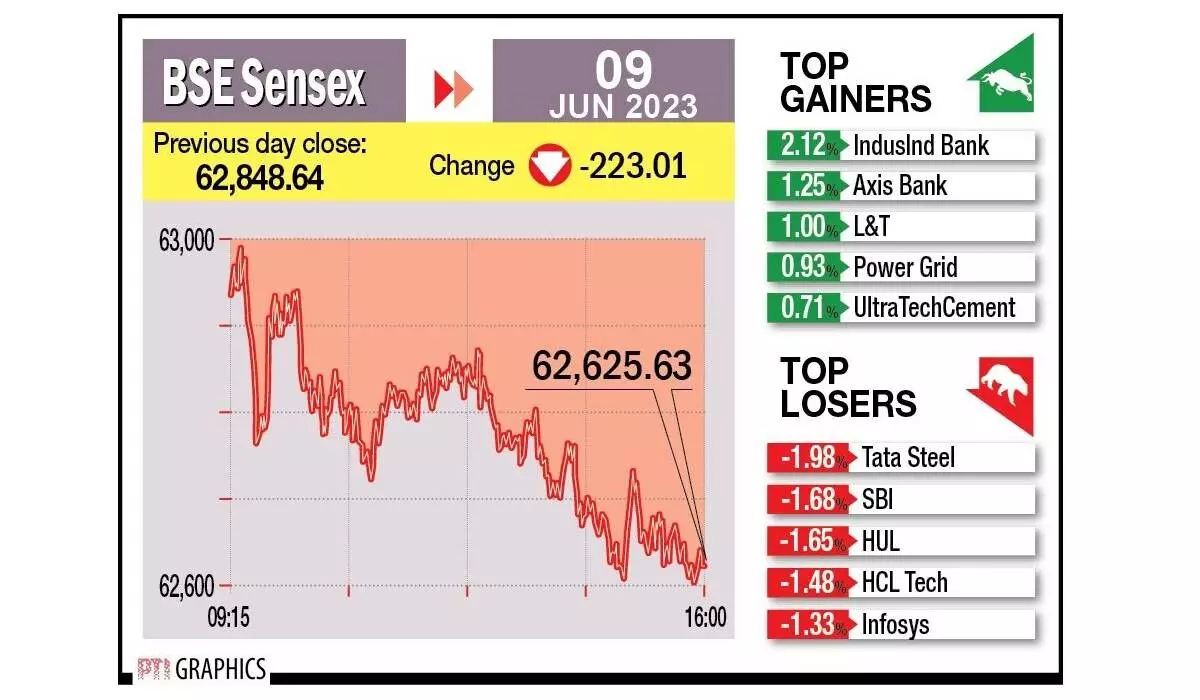

Mumbai Equity benchmark indices Sensex and Nifty stayed on the back foot for the second straight session on Friday as investors offloaded FMCG, IT and teck stocks amid a weak opening in European markets. Selling pressure in index heavyweight Reliance Industries also impacted the market sentiments. The 30-share BSE Sensex fell 223.01 points or 0.35 per cent to settle at 62,625.63. During the day, it declined 253.9 points or 0.40 per cent to 62,594.74. The NSE Nifty went lower by 71.15 points or 0.38 per cent to end at 18,563.40. On a weekly, the BSE benchmark climbed 78.52 points or 0.12 per cent, while the Nifty gained 29.3 points or 0.15 per cent.

“The domestic market witnessed extended selling pressure as investors eagerly awaited the domestic inflation data due on Monday as the RBI refrained from an aggressive cut in their inflation forecast. In addition to the domestic factors, global cues also failed to provide support, as the US reported high unemployment claims ahead of the release of the inflation figures and the Fed meeting,” said Vinod Nair, head (research) at Geojit Financial Services.

“Most Asian stocks rose on Friday, as weak US labour data ramped up bets on a pause in the US Fed's rate hike cycle, although disappointing inflation readings from China capped broader gains. European stocks slipped at the open on Friday as traders were cautious ahead of the policy meetings of key central banks next week,” said Deepak Jasani, head (retail research), HDFC Securities.

“Focus now shifts to the US consumer inflation report for May, due on June 13, ahead of the Fed meeting, which will provide investors more clarity about the health of the world's largest economy,” said Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities Ltd.

Foreign Institutional Investors (FIIs) bought equities worth Rs 212.40 crore on Thursday, according to exchange data.

The broader market ended flat, with the BSE midcap gauge climbing marginally by 0.03 per cent and smallcap index went up by 0.02 per cent. Among the indices, FMCG fell 0.82 per cent, teck declined 0.79 per cent, IT (0.68 per cent), metal (0.66 per cent), commodities (0.58 per cent) and consumer durables (0.58 per cent). Industrials, telecommunication, utilities, capital goods and power were the gainers.